Sunday, October 4, 2009

Friday, October 2, 2009

Tax Credit Ends November 30th

Tax credit ends soon get your information in. www.hmrhomeloans.com apply online fast easy and safe. We are the bank, we lend our own money.

Sunday, September 27, 2009

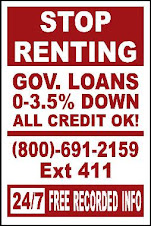

24/7 Recorded Real Estate Information

24/7 Free Recorded Information.

Looking for a strong finish on the home buyers tax credit program. If you are interested you need to have your application in by mid October. Start here online www.hmrhomeloans.com

Go to the application and fill it out.

Also shop the USDA site and HUD site for home that are one dollar down.

Thursday, September 24, 2009

hmrhomloans.com Mortgage Forms online downloadable

Go to our site to down load forms for purchase or refinance application.

Tuesday, September 22, 2009

www.hmrhomeloans.com online application.

Looking for a few new friends.

Hello again, its well into September and the $8000 tax credit will end soon. To take advantage of this program your application should be in by mid October. You can do this by visiting our web site hmrhomeloans.com and complete the online application. Fast, and simple at your own pace.

Things are still changing in our industry some good some bad, we are working hard to help you with your purchase or refinance needs. Call us at 208 577-5300

Thank you, Kenneth Dunn

Hello again, its well into September and the $8000 tax credit will end soon. To take advantage of this program your application should be in by mid October. You can do this by visiting our web site hmrhomeloans.com and complete the online application. Fast, and simple at your own pace.

Things are still changing in our industry some good some bad, we are working hard to help you with your purchase or refinance needs. Call us at 208 577-5300

Thank you, Kenneth Dunn

Friday, June 26, 2009

Tuesday, June 23, 2009

Looking for a few new Realtors and a Loan Officer.

Working on growing our staff members for our new Eagle loacation with SilverHawk Realty. Currently looking for a Loan Officer and Realtors to join our team. We are closing loans. Do you need a new place to work from, better terms, just tell me and I will see if we can make it happen.

Saturday, June 13, 2009

Subprime Lending Again?

Subprime Lending is coming back? Former Beneficial Finance official Peter Cugno thinks the time is ripe to start a wholesale subprime lending company. A mortgage trainer the past few years, Mr. Cugno put out a press release saying he is in the process of raising capital and obtaining the proper licensing. He plans to run the company under the subprime model of yesteryear: when funders closely underwrote loans with a microscope and required refi applicants to have real equity...

Friday, June 12, 2009

We Have Money to Loan Refi or Purchase Loans.

Thank you in advance for checking into our blog.

Here is whats new! Rates are on the rise and if you have been waiting on the sidelines you may have missed the lowest rate for the year. But,there is an option which to consider. FHA adjustable or VA Adjustable rates are very good options. You need to know more about these programs and what the goverment adjustable can do for you, and how safe the are.

WE HAVE MONEY TO LEND!

Are you renting?? There are still many programs for first-time borrowers that will allow 100% financing. You need to check these out. CALL US: 208-577-5300

We are working with select Realtors, would you like to be one? Call me.

We currently have manufactured money to lend....conventional loans..yes!

Do you need to refinance your manufactured home and do not want to pay mortgage insurance, we can do that!

Our loan officer Dylan Cline will be at Eagle Fun Days Saturday at 5:30 stop by and say hello.

Thanks Ken,

208-577-5300

Here is whats new! Rates are on the rise and if you have been waiting on the sidelines you may have missed the lowest rate for the year. But,there is an option which to consider. FHA adjustable or VA Adjustable rates are very good options. You need to know more about these programs and what the goverment adjustable can do for you, and how safe the are.

WE HAVE MONEY TO LEND!

Are you renting?? There are still many programs for first-time borrowers that will allow 100% financing. You need to check these out. CALL US: 208-577-5300

We are working with select Realtors, would you like to be one? Call me.

We currently have manufactured money to lend....conventional loans..yes!

Do you need to refinance your manufactured home and do not want to pay mortgage insurance, we can do that!

Our loan officer Dylan Cline will be at Eagle Fun Days Saturday at 5:30 stop by and say hello.

Thanks Ken,

208-577-5300

Tuesday, June 9, 2009

First Time Home Buyer

Home Mortgage Resources 5466 E Franklin Rd Nampa Id 83687 208-577-5300: Below are some questions answered about the First Time Homebuyers Tax Credit, as well as some additional programs offered in Idaho that coincide....

Is the program available to all first-time homebuyers?

Yes - the program is available now until December 1, 2009 for qualifying first-time homebuyers or home buyers who have not owned a home within the last three years.

The National Association of REALTORS® is actively working to extend the credit through 2010 and permit all purchasers to utilize it.

Does Idaho have a way for a homebuyer to access the funds for a down payment?

Yes - With ACARs encouragement, The Idaho Housing and Finance Association implemented the Tax Credit Advance Loan to access funds at the time of closing. Idaho is one of 10 states offering the advance.

IHFA’s Down Payment Assistance Tax Credit Advance

The American Recovery and Reinvestment Act of 2009 provided a federal income tax credit for first-timehomebuyers of 10% of the sales price, up to a maximum of $8,000. This tax credit is available to qualified home buyers who purchase a home by December 1, 2009. In order to help buyers monetize this tax credit for down payment and closing costs when they purchase a home, Idaho Housing and Finance Association (IHFA), through its IdaMortgage lending program, is offering a special short-term

Tax Credit 2nd Loan to qualified buyers.

In conjunction with an IdaMortgage loan, a subordinate loan will be offered to qualified borrowers of up to $7,000, not to exceed 100% CLTV at 3.0% interest and with a due date of July 1, 2010. The Tax Credit 2nd Loan is expected to be paid off from the borrowers tax refund obtained through use of the federal tax credit. Borrower qualifications are; 1) first time homebuyer, 2) FICO score of no less than 640, and a total debt ratio of no more than 45% , 3) completed certification from the home buyer and a qualified tax preparer that he/she expects a tax refund of at least the amount of the loan, and 4) qualifies for an IdaMortgage loan. First time homebuyers with credit scores of 700+ will not be required to produce a certification.

In Idaho will the REALTOR® Associations pay off interest on the tax credit advance loan?

Yes - To help encourage home ownership, REALTORS® Associations in Idaho created the Welcome Home Idaho program. REALTORS® in Idaho have offered to pay off the interest on the tax credit loans to individuals who pay off the loan by the due date of July 1st 2009. The availability of the payoff is on a first come first served basis until the contributed funds are gone.

Can lenders is Idaho access the tax credit advance loan?

Yes - According to IHFA, "any lender making that statement they will not utilize the credit is doing so based on an internal company policy. There is no reason that every approved IHFA lender cannot offer the Tax Credit Advance right now. In fact nearly 800 Idahoans have applied for it since it was introduced in March." For a list of IHFA approved lenders go to www.ihfa.org

If you or anyone you know is interested in taking advantage of these tax credits, or has any questions about the state of today's market, please contact me, I'd love to help out in any way I can!

Is the program available to all first-time homebuyers?

Yes - the program is available now until December 1, 2009 for qualifying first-time homebuyers or home buyers who have not owned a home within the last three years.

The National Association of REALTORS® is actively working to extend the credit through 2010 and permit all purchasers to utilize it.

Does Idaho have a way for a homebuyer to access the funds for a down payment?

Yes - With ACARs encouragement, The Idaho Housing and Finance Association implemented the Tax Credit Advance Loan to access funds at the time of closing. Idaho is one of 10 states offering the advance.

IHFA’s Down Payment Assistance Tax Credit Advance

The American Recovery and Reinvestment Act of 2009 provided a federal income tax credit for first-timehomebuyers of 10% of the sales price, up to a maximum of $8,000. This tax credit is available to qualified home buyers who purchase a home by December 1, 2009. In order to help buyers monetize this tax credit for down payment and closing costs when they purchase a home, Idaho Housing and Finance Association (IHFA), through its IdaMortgage lending program, is offering a special short-term

Tax Credit 2nd Loan to qualified buyers.

In conjunction with an IdaMortgage loan, a subordinate loan will be offered to qualified borrowers of up to $7,000, not to exceed 100% CLTV at 3.0% interest and with a due date of July 1, 2010. The Tax Credit 2nd Loan is expected to be paid off from the borrowers tax refund obtained through use of the federal tax credit. Borrower qualifications are; 1) first time homebuyer, 2) FICO score of no less than 640, and a total debt ratio of no more than 45% , 3) completed certification from the home buyer and a qualified tax preparer that he/she expects a tax refund of at least the amount of the loan, and 4) qualifies for an IdaMortgage loan. First time homebuyers with credit scores of 700+ will not be required to produce a certification.

In Idaho will the REALTOR® Associations pay off interest on the tax credit advance loan?

Yes - To help encourage home ownership, REALTORS® Associations in Idaho created the Welcome Home Idaho program. REALTORS® in Idaho have offered to pay off the interest on the tax credit loans to individuals who pay off the loan by the due date of July 1st 2009. The availability of the payoff is on a first come first served basis until the contributed funds are gone.

Can lenders is Idaho access the tax credit advance loan?

Yes - According to IHFA, "any lender making that statement they will not utilize the credit is doing so based on an internal company policy. There is no reason that every approved IHFA lender cannot offer the Tax Credit Advance right now. In fact nearly 800 Idahoans have applied for it since it was introduced in March." For a list of IHFA approved lenders go to www.ihfa.org

If you or anyone you know is interested in taking advantage of these tax credits, or has any questions about the state of today's market, please contact me, I'd love to help out in any way I can!

Sunday, May 24, 2009

Article: Twitter Takes Real Estate Sales by Storm

MEMPHIS, Tenn. - The real estate market is heading into cyberspace as agents search for creative ways to reach home buyers.

Click Here to view full article

Click Here to view full article

Subscribe to:

Comments (Atom)